Who Should & Who Shouldn't Have a Home Warranty?

Do you really need a home warranty? For many consumers, the answer is "probably not."

There are some things you really need and others that are options. Homeowners insurance isn’t an option. If you have a mortgage on your home, your mortgage company requires you to have an insurance policy, to protect its interests as well as yours. On the other hand, nobody requires you to have a home warranty.

So, you might ask – if homeowners insurance is a necessity, why isn't a home warranty? After all, it's supposed to save you time and money – time because you don’t have to spend all afternoon trying to find someone to come out and look at your ice maker and maybe money because your home warranty covers some of the cost of most repairs.

Well, one big reason is that many consumers say that their home warranty plans fall short – often failing to provide prompt and reliable repair services while sticking the homeowner with unexpected fees for each service call. And then there are the deductibles, which can make them the entire transaction economically questionable.

We'll take a look at the pluses and minuses in this article which, by the way, is not an advertisement in disguise. It is not funded by warranty companies and is not trying to sell you anything. We don't track you and you will not receive any sales material as a result of reading this story.

Follow the money

Some things are emotional – like the color of the living-room drapes. Others are strictly financial, like home maintenance, which is an expense that will be paid one way or another. It's a "pay me now or pay me later" situation.

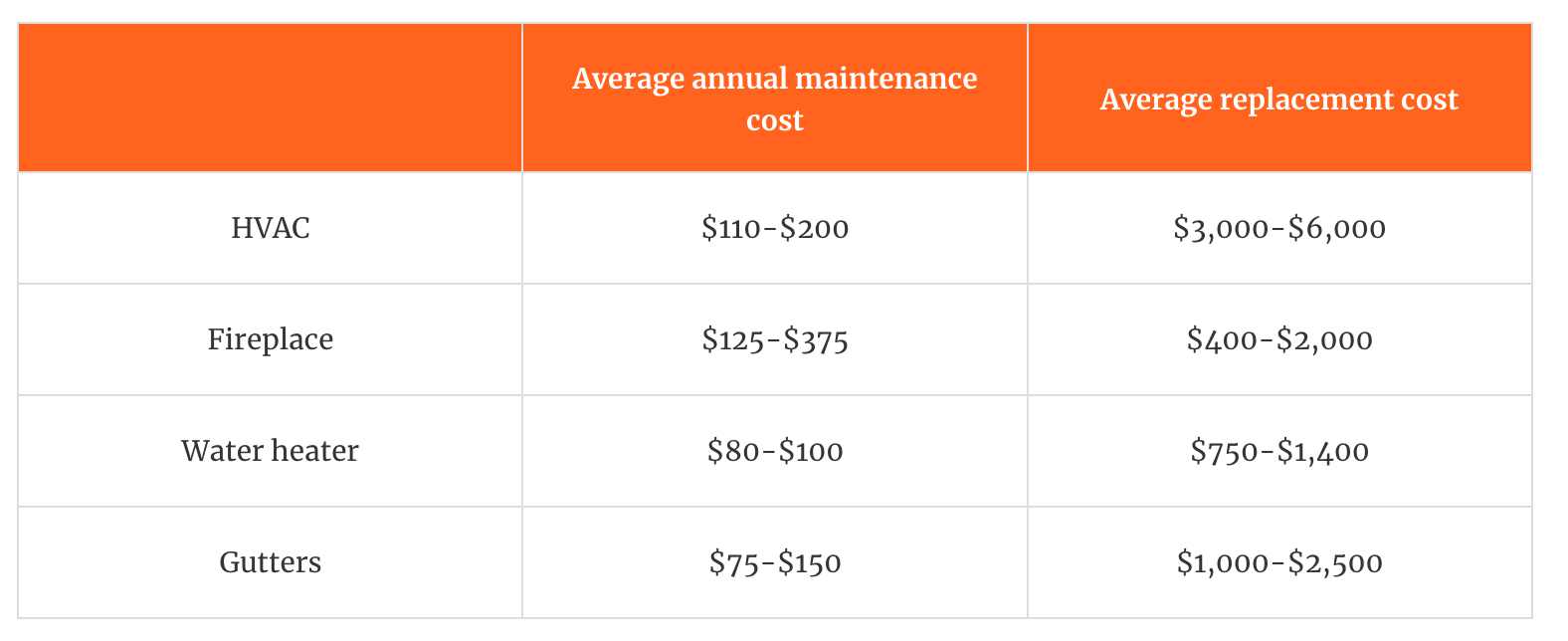

It costs a little bit to maintain things on a regular basis, a lot more if you wait until something melts down. Here's an estimate from American Family Insurance of regular maintenance costs versus onetime replacement cost:

Who needs it?

Basically, everyone is exposed to home maintenance expenses which must be paid one way or another. A home warranty is one way of trying to ensure that you'll have the funds to make necessary repairs. There are roughly four kinds of homeowners who may want to consider a home warranty.

Anyone with an older home

Older homes are great. They're often in established neighborhoods, with mature landscaping and plenty of add-ons newer homes don't have. But they're older, so there are more things to go wrong. Older appliances, older water heaters, and so forth.

Anyone selling a home

Realtors say a home warranty gives buyers more confidence that their home won't turn into a money pit on Day One. Most warranties can be transferred to the new owners for an initial term of one year.

Anyone buying a home

See above. A home warranty gives buyers some assurance that their home will be trouble-free and thus makes them easier to sell. New homes almost always come with a warranty of a year or so, paid for by the builder.

Landlords

Do you really want your tenants calling you at 5 a.m. to tell you there's no hot water? Many commercial property companies contract with home warranty companies to service their rental units. So do many individuals who own rental property. Besides saving the landlord time and money, a home warranty assures prospective renters that the property is well cared-for.

Who doesn't need it?

But having said all that, there are plenty of consumers who might not need a home warranty.

For example, anyone buying a new home from the builder probably doesn't have to worry about a home warranty for two reasons:

You will often have the option to buy an immediate extension of the builder's warranty, to maintain your protection after the initial warranty expires. This may be worth doing, depending on the terms.

Many credit cards provide an extended warranty for items purchased with the card. So if you buy a new microwave oven, you might get the manufacturer's warranty plus another year or two of coverage from your credit card. American Express, for example, offers one year beyond the manufacturers' warranty for items purchased with its Platinum Card.

Who else can do without?

There are some people who can get along just fine without a home warranty. For example:

Wealthy people

Consumers who are truly high net worth individuals (with $1 million or more in liquid assets) can easily pay for routine home maintenance, and they can even let things slide a little if they feel like it. Hey, it's only money.

Disciplined people

Consumer Reports suggests that homeowners self-insure rather than buying a home warranty. This means they would put money into a savings account each month equal to what they would pay for a home warranty.

Dedicated DIYers

There are some people who can fix anything and have the time and motivation to do so. They are probably better off doing just that.

So, what do they cost?

Costs vary from one company to another and on how much coverage a consumer buys, but in general the annual fee for a basic plan ranges from $400 to $800 or so per year. Most companies charge a service fee each time you submit a claim. Those fees generally range from $75 to $125, depending on which company and plan you choose. There is normally a deductible of $60 to $100 for each claim.

Some plans cover almost literally everything in the home. They tend to be more costly. You can save money by getting a plan that covers the big items – like heating and plumbing – but not smaller appliances like microwave ovens and home electronics.

“The most important thing for the average consumer would be the highest-value items in the home. For instance, the air conditioning or heating system. Those typically are going to cost several thousand dollars to replace, if not more, depending on the system and whether it’s split or one unit.” - Chad Marzen, Assoc. Prof. of Insurance Law, Florida State University

Should you have one?

Most people don't think so. The majority of homeowners don't have a home warranty. No one knows the exact number but experts say fewer than 10% of homeowners nationwide have warranties.

They're on the right track, say the experts at Consumer's Checkbook, a non-profit consumer group. It urges consumers not to buy home warranties. Although the companies that sell these policies promise their coverage can save thousands of dollars in potential repair bills, you can’t count on them to provide that peace of mind, the group says:

These plans are typically terrible deals for most buyers. They are costly and don’t fully cover the most expensive types of problems. Plus, when things do go wrong, these warranties tend to dispatch third-party repair companies that are beholden to the home warranty company, not to you. Often, the contractors they send do awful work.

Read more of Consumer Checkbook's advice here. They make some worthwhile points.

The takeaway

So, what's the verdict? It's really up to the individual consumer but it's hard to argue with the idea that it's better to set up a maintenance fund and pay into it each month, so that you have the money to make repairs that are bound to crop up from time to time. You'll even make a few dollars interest along the way.

There's also something to be said for getting to know service people in your community. A home warranty company probably won't send the same technician each time you call. But if you build a relationship with a handyman, plumber and HVAC technician, you'll be dealing with a known quantity, which should translate into better service at a fair price.

Whatever you want to call it, a home warranty is insurance – and all insurance is expensive and has a lot of loopholes. Home warranties are no exception. They may be helpful in some cases but most consumers are probably better off without them.