When Is a Loan Not a Loan?

Everyone knows that using credit to make purchases is handy but can also be expensive and risky to your financial well-being. Using cash is sometimes better but can deplete your cash supply.

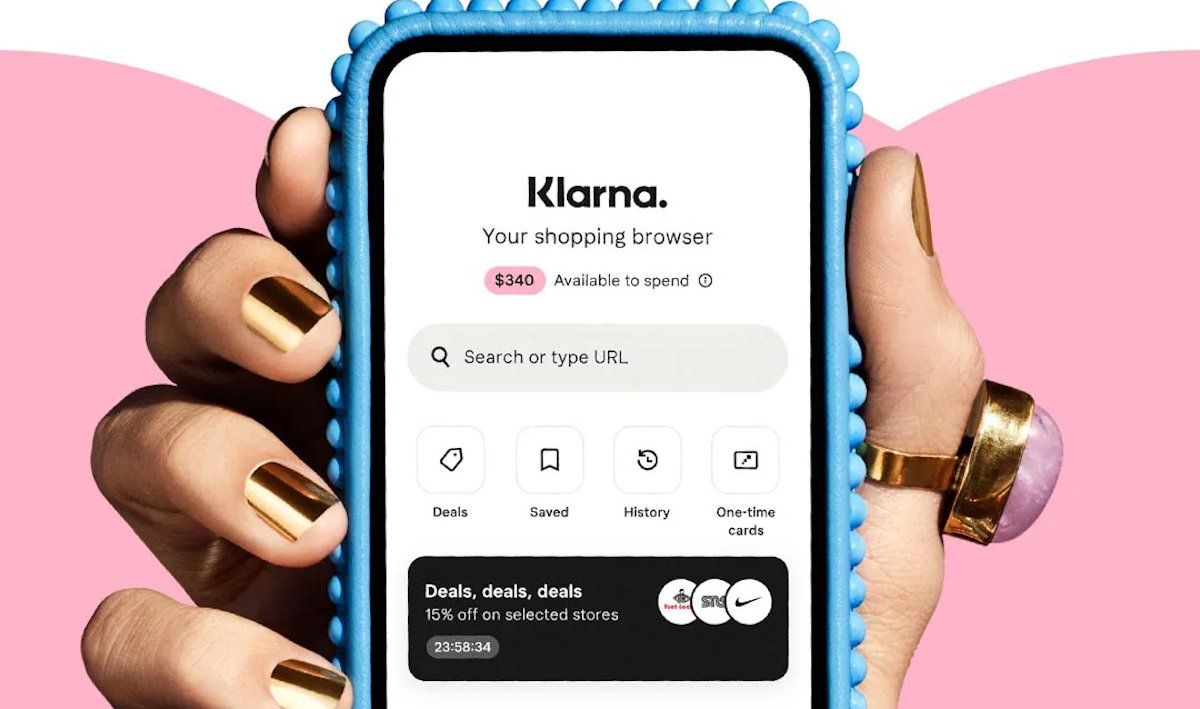

That’s where something called “Buy Now, Pay Later” comes in. It’s not exactly a new idea, being somewhat similar to the old layaway programs once offered by major retailers. In its simplest form, Buy Now, Pay Later allows a consumer to make a purchase and pay for it in a few installments, often with no interest charges.

But not everyone thinks this is such a great idea. The Consumer Financial Protection Bureau (CFPB) has expressed concerns about whether the programs can lure consumers into accumulating more debt than they can handle. There are also concerns about the widespread data harvesting that has expanded into every corner of commerce.

As part of its attempt to get a handle on the fast-growing phenomenon, the CFPB has issued orders to five companies offering the plan: Affirm, Afterpay, Klarna, PayPal, and Zip.

“Buy Now, Pay Later is the new version of the old layaway plan, but with modern, faster twists where the consumer gets the product immediately but gets the debt immediately too,” said CFPB Director Rohit Chopra. “We have ordered Affirm, Afterpay, Klarna, PayPal, and Zip to submit information so that we can report to the public about industry practices and risks.”

Safer than a credit card?

Promoters say that Buy Now, Pay Later is simpler and safer than using a credit card.

It’s certainly simpler. Consumers don’t have to provide nearly as much information as they do when applying for a credit card or loan. Promoters say it’s helpful to consumers with scan or unfavorable credit histories.

Buy Now, Pay Later deals can also be less expensive. Many require 25 percent of the purchase price at check-out and typically charge lower interest than other forms of credit. Some programs don’t charge any interest at all.

Where’s the profit?

So how do the programs turn a profit? Merchants typically pay 3 to 6 percent of the purchase price to the program operator, hoping that offering the Buy Now, Pay Later option will increase sales.

No matter your industry, Affirm’s tailored programs remove price as a barrier, boosting cart conversions, increasing average order value, and expanding your customer base.- Affirm.com

It certainly seems to work. Buy Now, Pay Later sales skyrocketed during the recent Black Friday and Cyber Monday sales events and new companies are gearing up to enter the field.

CFPB probing for more data

The CFPB is required by law to monitor consumer financial markets and its requests for data from the five companies is part of that effort. In a news release, the bureau said it is particularly interested in three aspects of the Buy Now, Pay Later craze:

Accumulating debt: Whereas the old-style layaway installment loans were typically used for the occasional big purchase, people can quickly become regular users of buy now pay later for everyday discretionary buying, especially if they download the easy-to-use apps or install the web browser plugins. If a consumer has multiple purchases on multiple schedules with multiple companies, it may be hard to keep track of when payments are scheduled. And when there is not enough money in a consumer’s bank account, this can potentially result in charges by both the consumer’s bank and the Buy Now, Pay Later provider. Because of the ease of getting these loans, consumers can end up spending more than anticipated.

Regulatory arbitrage: Some Buy Now, Pay Later companies may not be adequately evaluating what consumer protection laws apply to their products. For example, some Buy Now, Pay Later products do not provide certain disclosures, which could be required by some laws. And while the Buy Now, Pay Later application may look similar to a standard checkout with a credit card, protections that apply to credit cards – like dispute resolution – may not apply to Buy Now, Pay Later products.

Data harvesting: BNPL lenders have access to the valuable payment histories of their customers. Some have used this collected data to create closed loop shopping apps with partner merchants, pushing specific brands and products, often geared toward younger audiences. As competitive forces pressure the merchant discount, lenders will need to find other sources of revenue to maintain growth and profitability, CFPB said. The Bureau would like to better understand practices around data collection, behavioral targeting, data monetization and the risks they may create for consumers.