Rising interest rate tide could sink a lot of boats

It's a touchy time to be a renter in the U.S. and it turns out it's not a great time to be a landlord either. You can blame rising interest rates for both conditions.

As the Fed keeps pressure on interest rates, landlords are being squeezed by rising mortgage payments on existing buildings and finding it difficult to finance new building projects. This puts pressure on tenants, who face rising rents, add-on fees and a shortage of affordable homes and apartments.

The Biden Administration is trying to intervene on behalf of tenants, recently announcing a crackdown on "junk fees" that drive up the cost of renting – things like pet fees, deposits and pest control fees as well as more exotic fees, like mail sorting, trash collection and even the somewhat mysterious "January fee," charged for no particular reason at the beginning of each year.

"Rental housing fees can be a serious burden on renters. Rental application fees can be up to $100 or more per application, and, importantly, they often exceed the actual cost of conducting the background and credit checks. Given that prospective renters often apply for multiple units over the course of their housing search, these application fees can add up to hundreds of dollars," the White House said in a statement.

The Biden Administration said it has already gotten commitments from rental housing platforms, including Zillow, Apartments.com and AffordableHousing.com, who have pledged to provider consumers with total, upfront cost information on rental properties.

"Too damn high"

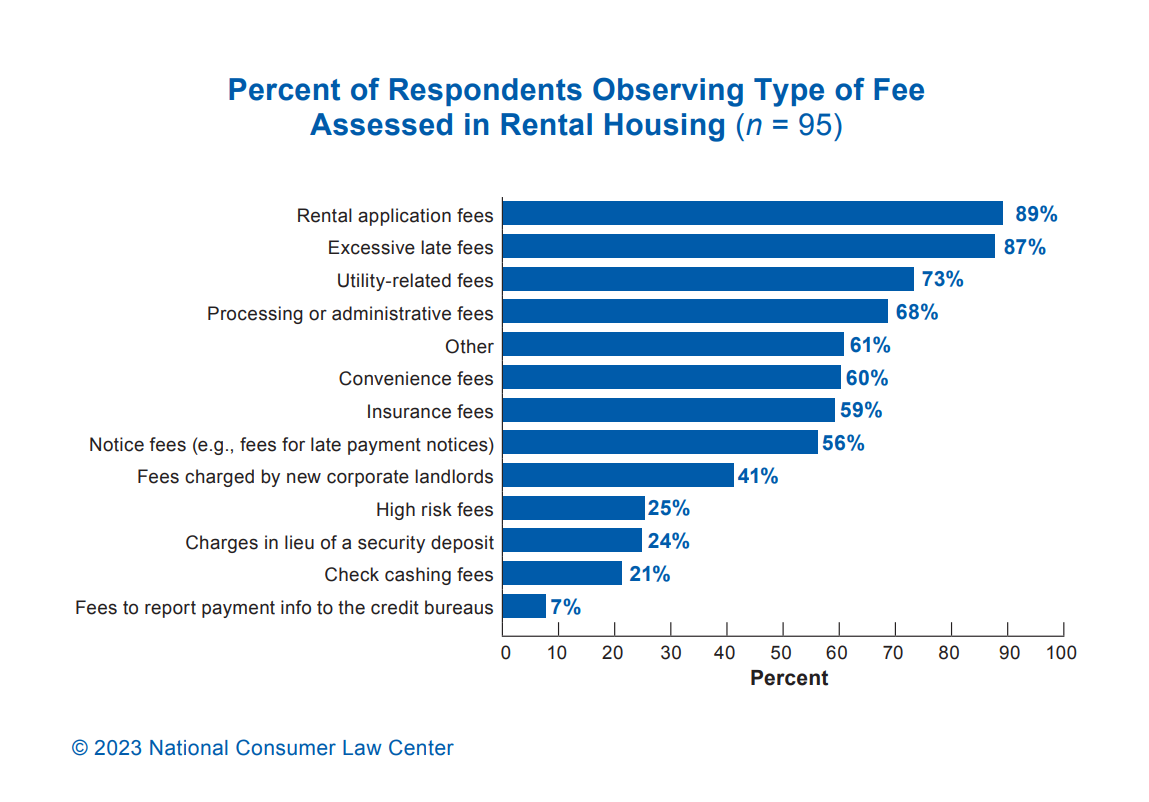

The actions follow a recent report by the National Consumer Law Center, Too Damn High: How Junk Fees Add to Skyrocketing Rents. It found that junk fees add to the already heavy burden that exorbitant rents place on renters, with over 40% of renter households — 19 million households — in the United States being “cost burdened” – paying over 30% of their income on housing costs.

"Rental housing junk fees put safe and decent housing even more out of reach because renters must pay them on top of sky-high rents,” said Ariel Nelson, staff attorney with the National Consumer Law Center.

“We are greatly encouraged that the Biden Administration is taking rental housing junk fees seriously, and we recognize that the measures announced today from private companies are steps in the right direction,” Nelson said.

Eviction rates

In good times and bad, eviction is a constant danger for tenants. Besides being thrown out of their homes for falling behind in rent payments or other problems, tenants can face eviction when landlords convert a building to condos or short-term Airbnb-type rentals or decide to sell or demolish the building.

In a typical year, landlords handle 3.6 million evictions. While the majority are in urban centers, the number of suburban evictions is also increasing, according to the Eviction Lab, a Princeton University research project.

Black renters and women are at highest risk of eviction and large landlords file eviction cases more often than smaller ones, the researchers found. In many cases, landlords use eviction proceedings as a tool to extract past-due payments from renters, who must pay back rent and add-on fees to remain in their homes.

How to avoid eviction? "Talk to a knowledgeable attorney," said Carol Sainthilaire, executive director of The Waterfront Project, a legal center that provides free civil assistance to renters in Northern New Jersey.

"A renter has almost no chance of prevailing against a landlord in court without legal assistance," Sainthilaire said. "The courts are crowded, judges are in a hurry and a lone tenant with no legal experience is more than likely going to lose. Coming to an organization like The Waterfront Project will also connect you to backrent assistance programs; however, those are dwindling. "

Most cities have legal aid clinics and rental assistance organizations. It's essential to contact one of them as soon as eviction is threatened, she said. Military personnel should talk to their local legal assistance center.

The Consumer Financial Protection Bureau (CFPB) has detailed information for residents facing eviction on its website.

Pressure on landlords

While it's not likely tenants will sympathize, it's worth noting that landlords are feeling the heat as well. Owning apartments used to be almost like an annuity – demand for affordable housing was high and the money rolled in as rents crept steadily upward.

While there's still a demand for affordable housing the good times no longer roll. Most commercial real estate owners are heavily leveraged, so that rising interest rates make it difficult to make mortgage payments.

The pressure on profits drives down the market value of landlords' property as well. The data service CoStar estimates that apartment building valuations dropped 14% last year and are continuing to fall. Landlords are also being hit by plummeting occupancy rates in office buildings as well.

Many commercial real estate developers launched massive building projects over the last few years and now face a potential glut as those new developments open for business, possibly creating an apartment glut in high-growth markets.

This spells big trouble for commercial real estate, with defaults growing in markets across the country. A glut of new apartments could be good for tenants in the short term but as conditions worsen and defaults grow, it's not likely renters will find many bargains.