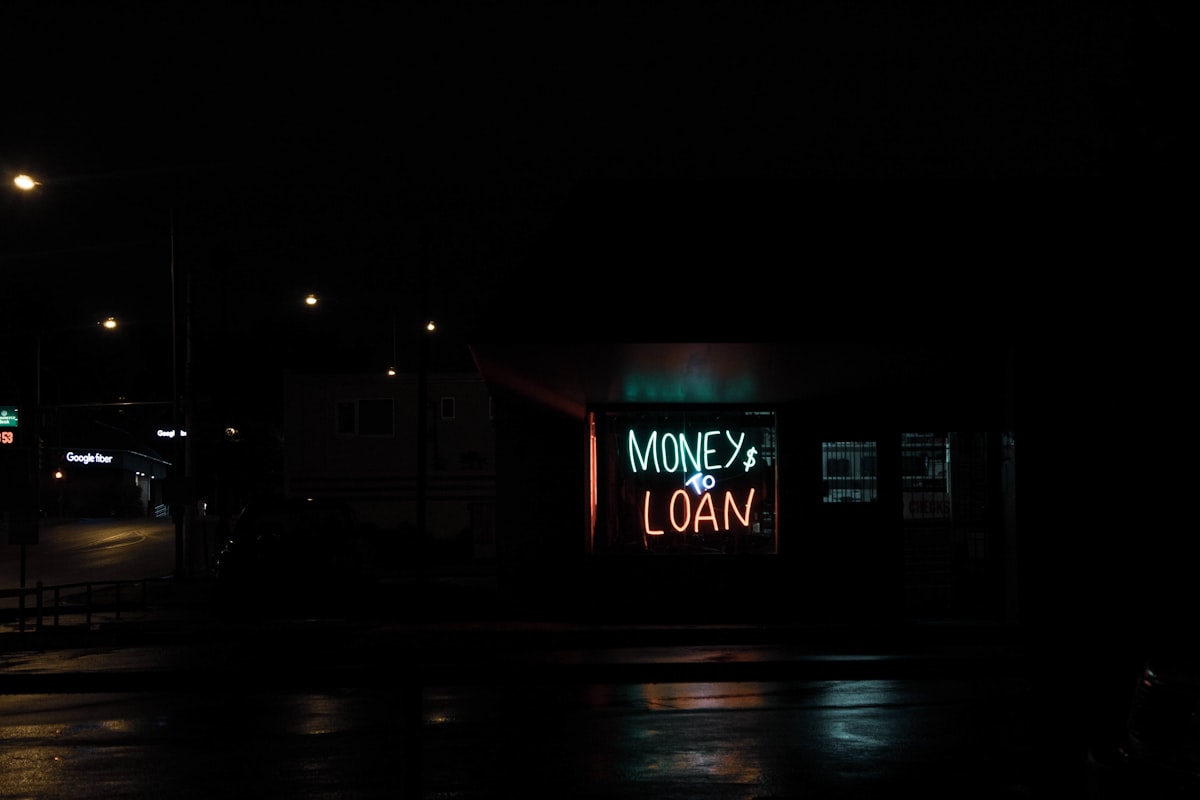

Predatory Payday and Car Title Loans Targeted by Senate Bill

Payday and car title loans trap millions of consumers in a revolving cycle of debt every year despite attempts by states and consumer activists to restrict them. That could change if a U.S. Senate bill reintroduced by Sen. Sherrod Brown (D-Ohio) and others passes.

The Veterans and Consumers Fair Credit Act would close loopholes in federal and state laws that allow predatory lenders to continue charging consumers interest rates as high as 600%.

“This important legislation is needed now more than ever as consumers across the country try to recover from the financial ruin caused by the COVID-19 pandemic,” said Rachel Gittleman, Financial Services Outreach Manager with the Consumer Federation of America (CFA).

Short term, high interest

Payday loans are short-term loans, usually for $500 or less, with interest rates that can be as high as 600%. Car-title loans similarly offer short-term, high interest cash loans using a car’s title as collateral.

According to a study by the Pew Charitable Trusts, as many as 12 million Americans use payday loans each year, most borrowing for routine expenses, with borrowers spending as much as $9 billion each year on payday loan fees.

Brown’s bill would build on the 2006 Military Lending Act and extend to veterans and all Americans the protections active duty military, their spouses and dependents currently receive. Among other things, it would cap the Annual Percentage Rate (APR) on loans at 36%, compared to rates that frequently top 600% in some states.

“Payday loans disproportionately target and harm those who have historically been excluded from mainstream financial services,” Gittleman said. “By disproportionately locating storefronts in majority Black and Latino neighborhoods, predatory payday lenders systemically target communities of color, stripping these consumers of wealth and further exacerbating the racial wealth gap.”

“Many Americans have to renew their loans so many times, they end up paying more in fees than the amount they borrowed,” said Brown. “We can put an end to these abusive debt traps by extending the Military Lending Act’s 36 percent cap on interest rates to everyone.”

Easy to get, hard to repay

“It’s so easy to just get a payday loan, but then when you can’t pay it back it ruins your credit, it makes you frustrated it makes you live really week by week,” said Gloria Olivencia of Lorain, who appeared at a news conference with Brown earlier this week.

“For an entire year I would have to give the lender my whole paycheck, and I had to take on more and more loans. I was so frustrated I didn’t know where to go or who to help me and legislation like this might help others who feel hopeless in the cycle of debt.”

Payday lenders slip through loopholes

The payday/title loan industry has continued to thrive despite state efforts to throttle it. Illinois recently became the 18th state to pass legislation restricting predatory lending. The measure caps interest rates at 36%.

Ironically, even states that have interest caps are often unsuccessful in curbing predatory lending, California being the most recent example to come to light.

Los Angeles Times Business Columnist David Lazarus reports in today’s edition that even though California has a usury law that sets a 10% cap on loans, everyone from banks to payday lenders violate it with impunity.

Why? As Lazarus explains it, there’s a loophole in the state Constitution specifying that the usury law’s 10% rate cap doesn’t apply to “any bank created and operating under and pursuant to any laws of this state or of the United States of America.”

A nationwide measure, like that being proposed by Brown and others, would close the California loophole, as well as others around the country.