Lemonade Entering Car Insurance Market

Lemonade might not sound like it has anything to do with car insurance. Of course, neither do Farmers, State Farm or Progressive, just to name a few. But if Lemonade has its way, you will soon associate it with car insurance, which it is adding to its existing pet, homeowners, renters and life insurance portfolios.

The company is what’s being called an “insuretech” venture. That’s because it uses artificial intelligence to “handle emergencies and pay claims fast … offer great prices to safe drivers and … be especially attractive to drivers of electric vehicles,” according to Shai Wininger, Lemonade chief operating officer and co-founder.

Lemonade Car, as it’s being called, will be offered to existing customers in the pet, homeowners, renters and life fields, most of whom the company says have cars and will be able to get multiple discounts by bundling their policies. Others can sign up using the company’s app, available in the Google and Apple app stores.

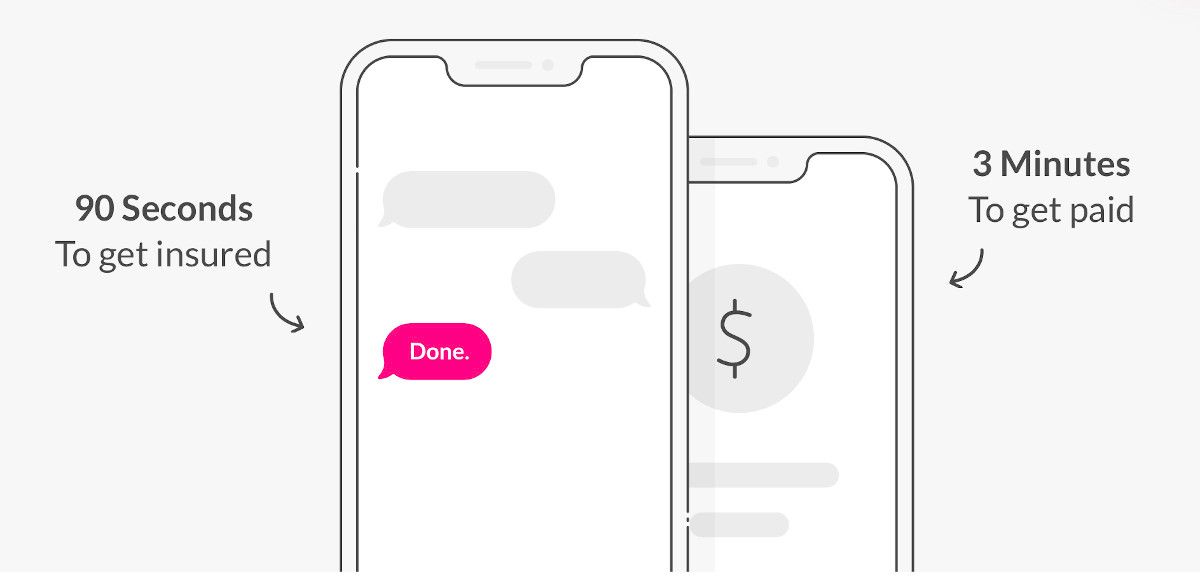

In fact, just about all transactions will be done through the apps. Lemonade claims its app can sell you a policy in 90 seconds and pay a claim in three minutes. It claims all this technology helps it keep rates lower than the competition.

The company also claims its high degree of automation makes it more fair and equitable but some critics have charged that there’s no way to know whether its algorithms will in fact be any less biased than humans.

CEO Daniel Schreiber says that’s nonsense. Schreiber says consumers want to be assessed as an individual, not by reference to racial, gender, or religious markers.

“If the AI is treating us all this way, as humans, then it is being fair. If I’m charged more for my candle-lighting habit, that’s as it should be,” he wrote in a blog post. Besides the U.S., the company operates in Germany, the Netherlands and France.