Governor Signs Illinois Payday Loan Bill

Illinois Governor J.B. Pritzker has signed a measure that’s expected to end the payday loan industry in Illinois. The Predatory Loan Prevention Act will cap interest rates at 36% on consumer loans, including payday and car title loans.

The state legislature passed the bill in January. It has been awaiting Pritzker’s signature since then.

“The Predatory Loan Prevention Act will substantially restrict any entity from making usurious loans to consumers in Illinois,” Pritzker said as he signed the measure today. “This reform offers substantial protections to the low-income communities so often targeted by these predatory exchanges.”

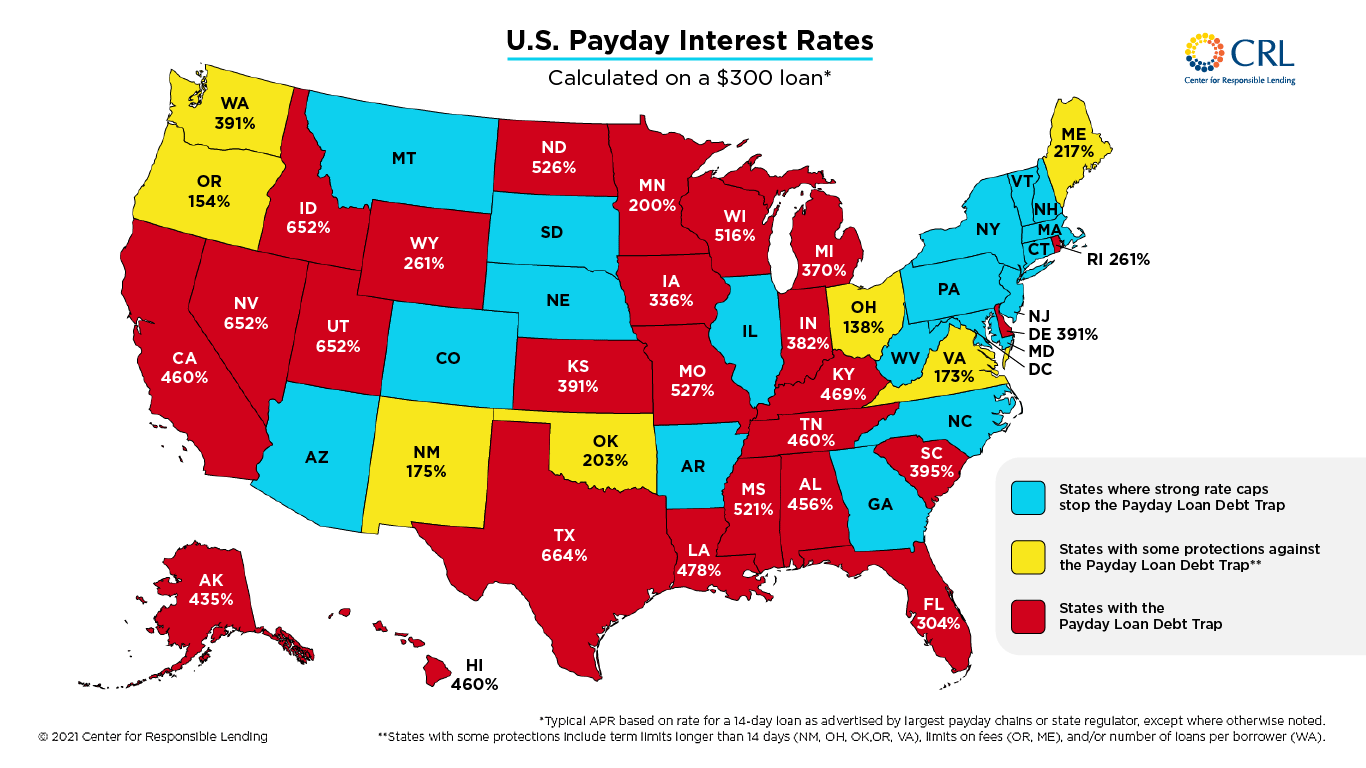

Seventeen other states and Washington, D.C., have imposed new interest rate limits with backing from more than 50 consumer, faith, labor, community, and civil rights organizations.

Nationwide trend

“As the bill becomes law, Illinois joins the strong trend across the nation toward passing rate caps to stop predatory lending. Eighteen states plus the District of Columbia have now rejected triple-digit interest predatory lending,” said Center for Responsible Lending Director of State Policy Lisa Stifler.

“Their protections cover over 100 million people nationally, keeping billions of dollars in the pockets of those with few resources, and opening up the market for healthy and responsible credit and resources that provide real benefits,” Stifler said.

The state efforts follow rollbacks by federal regulators including the Consumer Financial Protection Bureau (CFPB), which cut back protections against payday loans, and the Office of the Comptroller of the Currency (OCC), which issued a regulation that eviscerates the power of state interest rate caps.

The Illinois measure had strong backing from the state’s Legislative Black Caucus. It is modelled on the Military Lending Act, a federal law that protects active service members and their dependents through a range of safeguards, including capping interest rates on most consumer loans at 36%.

“The Predatory Loan Prevention Act will substantially restrict any entity from making usurious loans to consumers in Illinois,” Pritzker said Tuesday. “This reform offers substantial protections to the low-income communities so often targeted by these predatory exchanges.”

Prior to the legislation, the average annual percentage rate (APR) for a payday loan in Illinois was 297%, while auto title loans averaged APRs of about 179%, according to the Woodstock Institute, an organization that was part of a coalition formed in support of the legislation.

The Online Lenders Alliance said the measure was a “bad bill” for residents of the state.”