Florida Homeowners Face Higher Insurance Rates

Feb. 17, 2021

Florida and Texas have become quite aggressive in painting themselves as low-cost states and making a pitch for businesses and consumers looking to escape higher costs of living in such states as California, New York and Illinois.

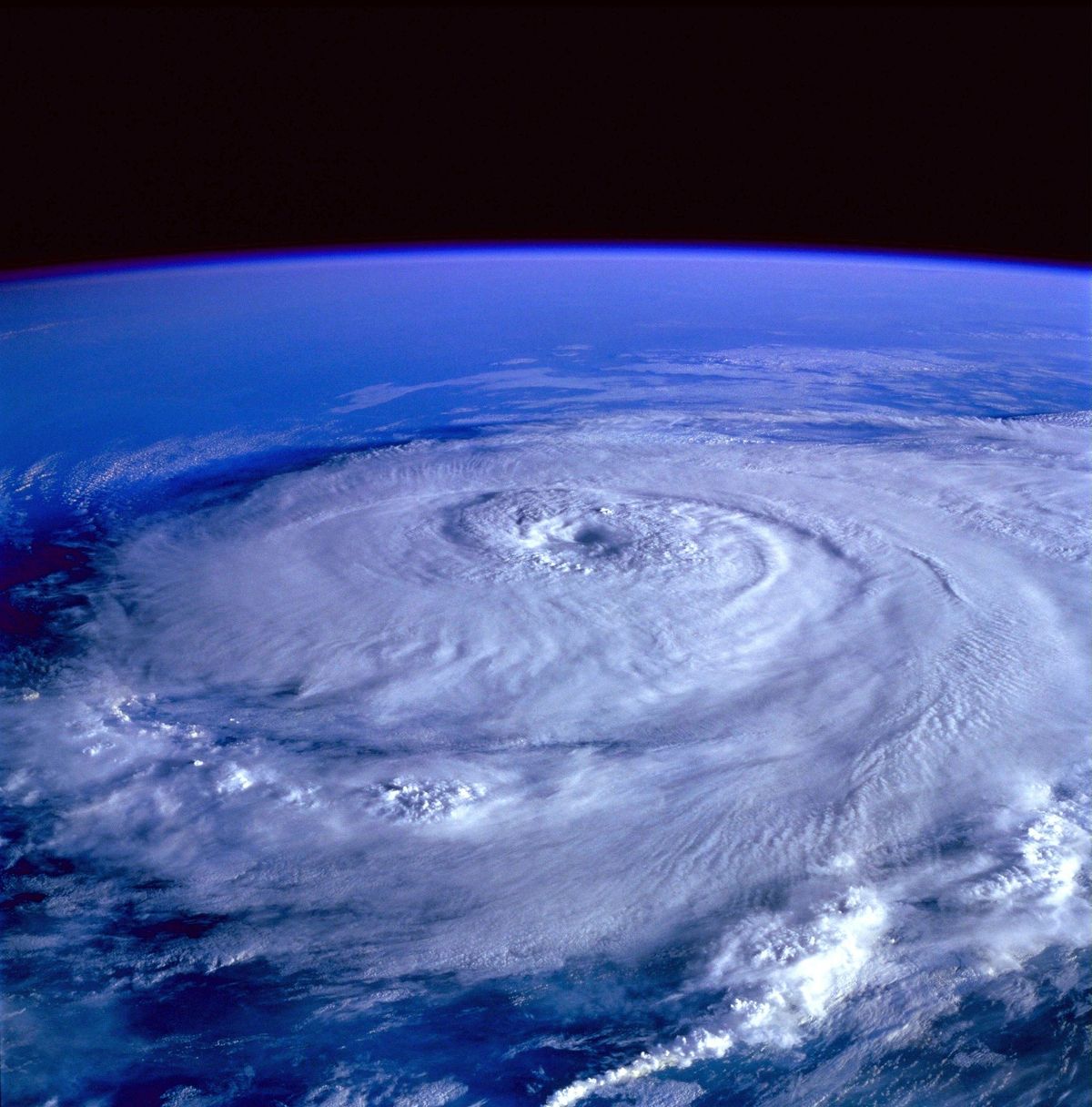

But while both states offer relatively low tax burdens, they also face frequent natural disasters, which can quickly run up the cost of insuring homes, cars and businesses.

Florida property insurers are jacking up rates by double-digit percentages, blaming the hikes on lingering damage from past hurricanes, a wave of litigation, and a law that encourages lawyers to sue by allowing courts to award them big fees.

Many major insurers fled the state after hurricanes Katrina and Wilma walloped them with huge losses in 2005. Today, most policies are written by about 60 small and mid-sized firms, according to a recent Insurance Journal article. underwriting property policies there today.

Besides the weather, the insurance industry blames lawyers and contractors for their woes. They complain that the lawyers and contractors often team up and sue insurers for unnecessary repairs — like replacing an entire roof instead of repairing just the damaged portion.

Whatever the cause, insurers are losing no time jacking up their rates. There were 105 requests for rate increases during the first ten months of 2020, more than half of them for more than 10%.

The Insurance Journal article quoted one homeowner as saying his insurance premium was now half as much as his entire mortgage payment.

Florida’s average home insurance rate is $3,643 which is nearly $1,338 more than the national average of $2,305, according to Insurance.com. Texas is even worse, with an annual average of $2,854, third highest in the country, according to Policy Genius, thanks to the tornadoes and hurricanes that target the state annually.

In case you’re wondering, Louisiana and Oklahoma have the highest average homeowners premiums, also owing mostly to hurricanes and tornadoes.

In California, the average cost of homeowners insurance is $1,280 per year, below the national average of $1,633. Rates are, of course, higher in areas that have high exposure to fires and other natural disasters.

New York is a relative bargain at $1,188.