Flood Insurance Rates Cresting at Highest Levels Ever in Some Areas

Hurricanes, rising sea levels, changing weather patterns put more homes at risk.

Enjoying your waterfront view? It's about to get a lot more expensive. The Federal Emergency Management Agency (FEMA) is "adjusting" its flood insurance rates to meet the new reality of bigger and more frequent floods in coastal and low-lying areas.

Increases of more than 300% are likely along some hurricane-prone parts of the East Coast. But other parts of the country are also in for adjustments that may make some housing unaffordable.

Although current owners will be stepped up to the new rates gradually, with existing homeowners limited to an 18% annual increase under federal law while new owners will have to pay the going rate.

This could catch some homebuyers by surprise if the seller doesn't spell it out clearly, so if you're buying a new home be sure to nail down the rate information. Sellers should disclose the change, if they know about it, but many may not.

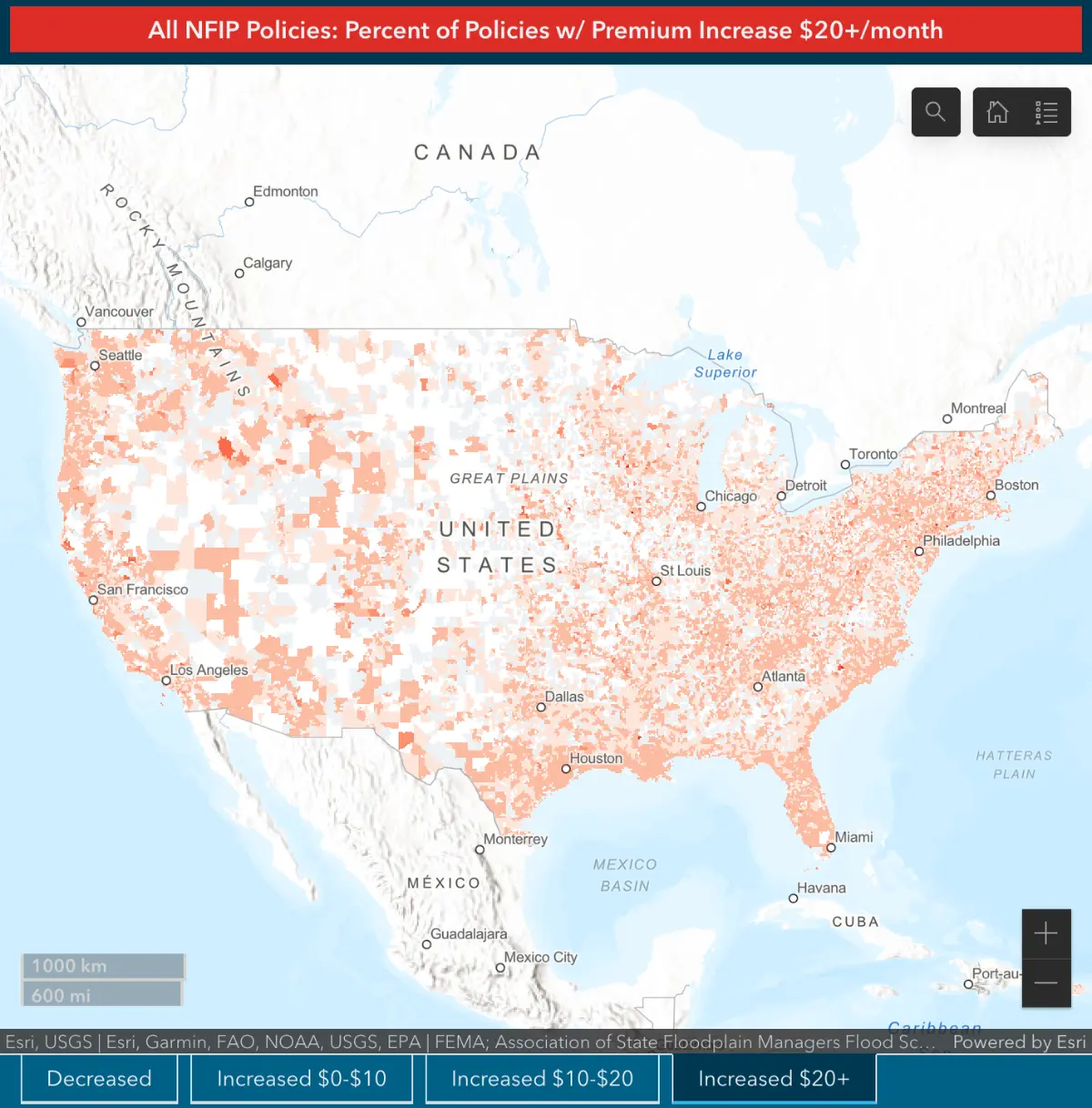

Take a look at FEMA's Zip Code map to find rate information in your area.

Southeast U.S. most at risk

Thanks to the prevalence of hurricanes and the rising water levels linked to climate change, the Southeast will take the biggest hit.

For one policyholder in a flood zone in Palmetto Bay, Florida, the annual premium will eventually climb from just over $1,000 to almost $5,000, said Clayton Fischer, an agent with Blue Marlin Insurance in Coral Gables, according to a report in the Insurance Journal.

In parts of Pensacola, the average flood premium will double, from $639 annually to $1,293. In Houma, Louisiana, southwest of New Orleans, the average premium will jump from $982 per year to $3,511, the Journal said.

Increases not a surprise

The latest increases are not a surprise. The national flood insurance program has been lsoing money for years. It was started when private insurers stopped offering policies in high-risk areas and has traditionally operated in the red, paying out more in claims than it collects in premiums.

Critics say homeowners should bear the cost themselves but Sen. Bob Menendez (D-NJ) and other politicians represent areas of the country – like the Jersey Shore – where the majority of homeowners are middle-class and would be unable to afford flood insurance without government support.

It’s not just homeowners who benefit from the coverage, said said Chad Berginnis, executive director of the Association of State Floodplain Managers, in an AP report.

“We are talking the basic economic health, I think of not only our households and businesses, but our communities at large,” if fewer people buy flood insurance, he said.