Don't Drive Much? Consider Pay-Per-Mile Car Insurance

The pandemic put a huge dent in traffic for awhile and appears to have turned many of us into permanent homebodies. And yet, most Americans are still paying the same auto insurance premium.

Does that make sense? Insurance is supposed to be based on risk, after all, and the risk of any particular car being involved in an accident obviously is lower if the car spends most of its time sitting forlornly in the garage.

Most insurers will grant a low-mileage discount to consumers who request it, assuming they are able to jump through all the hoops the insurance company can dream up but they don’t make it easy.

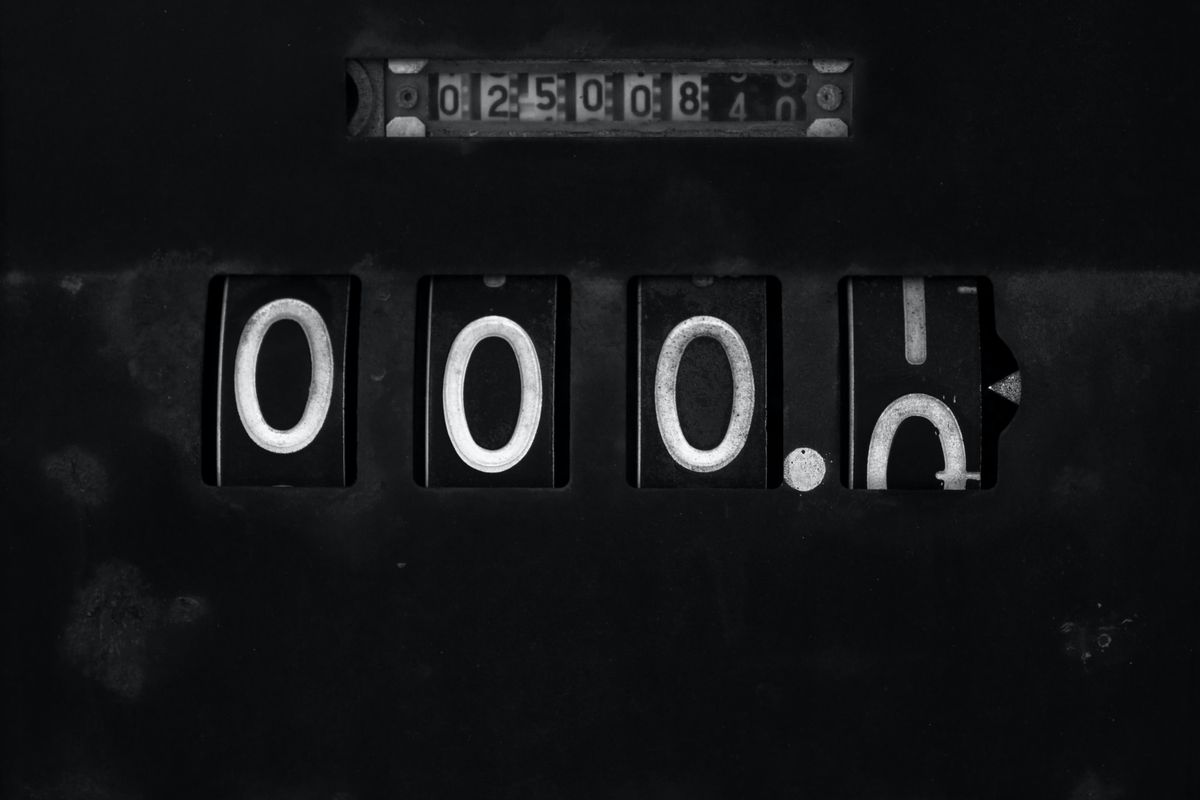

Through an odd confluence of factors, I own cars in Virginia and California and spend about six months in each state most years. That means at least one car just sits there for half a year. I tried to explain that to Geico and never got beyond pointing out that I couldn’t take a photo of the odometer in Virginia when I was in California.

Then, along came insurance-by-mile policies, offered by Metromile and several other companies. I signed up with Metromile the other day for the two cars in Virginia. There was some back-and-forth about certain traffic tickets and the rate ended up being a bit higher than advertised, since the person who drives the VW apparently has an elevated need for speed.

Metromile policies have a monthly base rate starting in the low 20-cent range plus a per-mile rate that’s based on the value of the car, your residence, driving record and all the usual things insurers like to fret about. Here’s how mine ended up:

Run the numbers

OK, time for math. We’ve been paying Geico $380.28 per month for the two Virginia cars. Assuming we drive each of our cars less than 500 miles per month we should wind up paying Metromile less than $200. Right?

Like lots of things, this looks good on a spreadsheet. How well it works out remains to be seen. We’ll check back in a few months.

Some assembly required

Right off the bat there was one slight wrinkle. Metromile sends you a little device to plug into your car, using what’s called the OBD-II port. This is a jack that is under the dashboard and – yes, you guessed it – it’s where the mechanic a/k/a service technician plugs in the diagnostic tester to see what’s up with your car.

Intalling it amounts to plugging it in, which requires nothing more than crouching into an extremely difficult position while simultaneously groping around under the dash and hitting your head on various hard objects.

The VW was fine with this, having nothing to hide (well, there was that little emissions incident but …). The Mercedes, being by definition rather haughty about most things, immediately protested. An error notice popped up on the screen warning that there would be consequences and instructing that the device be removed at once (not an exact quote but you get the idea). So far, I haven’t experienced any consequences but we shall see, I guess.

How much do you value your privacy?

Another potential drawback in this little scenario may not matter to everyone but to those who are touchy about privacy, it could be a deal-breaker.

If you read the fine print in the packaging of the plug-in device, it not only records your miles driven but also “speed, heading, acceleration, deceleration, altitude, periodic odometer readings, collision and impact … and any other information (collectively Data).”

Oh, and also, you of course “consent that we may use any Data in assessing any claim.” If you trash the device it “can result in a denial of any claim.”

So, basically, your insurer is doing a ride-along with you and taking careful notes. Now, Google and the rest of the online gang keep a careful eye on your comings and goings too, though perhaps not to this extent. Also, they don’t have your car insurance in the palm of their hand.

It’s probably sound policy from an underwriting standpoint to be able to spot policyholders who routinely drive 90 miles per hour or stand on the brakes a little too often, but it may rub some people the wrong way. It’s certainly something to be aware of before you take the leap.

More per-mile insurance options

Nearly all insurance companies claim they will give you a discounted rate if you can prove you don’t drive much, but it can take quite a bit of negotiating to get anything worthwile.

So far, there aren’t many companies offering straight per-mile plans. Besides Metromile, there’s Mile Auto, Nationwide SmartMiles and Milewise from Allstate.

These companies all use the same type of device as Metromile. None of them is yet available in every state so you may have to shop around a little.

And by the way, all of them offer some kind of protection for occasional roadtrips. They’ll let you drive a few hundred miles every now and then with a cap of some kind, so you don’t wind up spending $600 to go see your grandmother.

The links in this story are for your information only. They are not advertisements. We do not receive any compensation from companies linked to in our articles.