Car Insurance Rates Produced Windfall Profits During the Pandemic

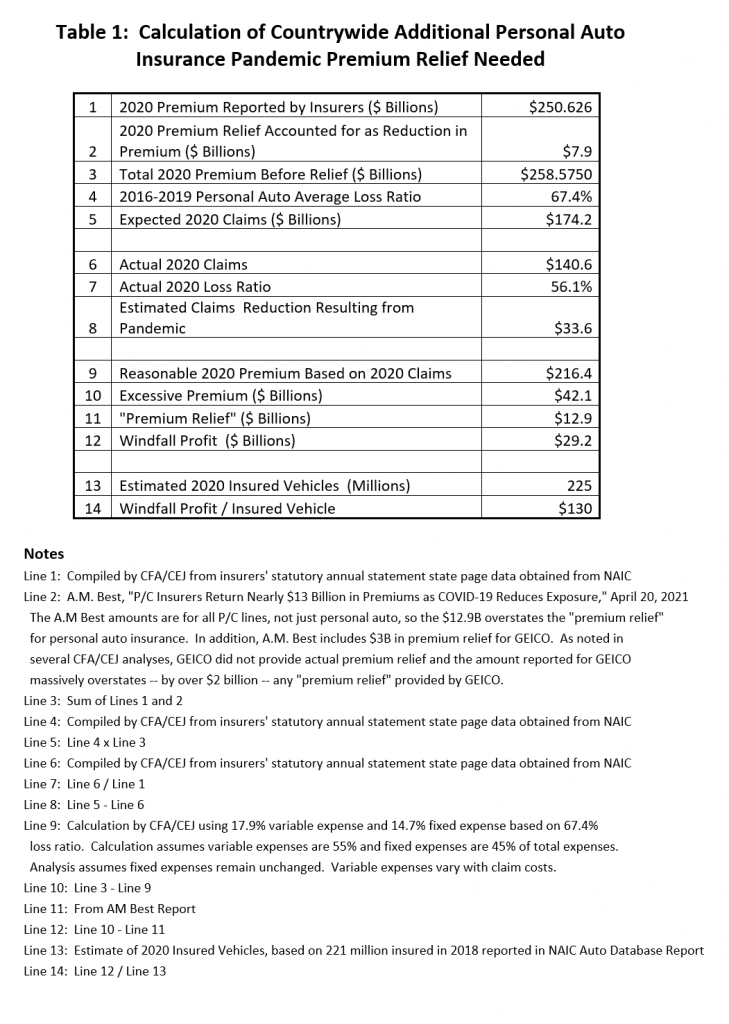

Auto insurance companies made windfall profits of at least $29 billion in 2020 despite their promise to reduce rates as consumers drove less during the pandemic.

Insurers provided $13 billion in premium relief while pocketing $42 billion in excessive premiums, according to a study by the Consumer Federation of America (CFA) and Center for Economic Justice (CEJ).

Instead of returning the windfall, insurers spend it on increased salaries for top management and dividends to stockholders, CFA and CEJ said.

Insurance regulators did nothing

Despite the obvious reduction in miles being driven in early 2020, the vast majority of insurance regulators did nothing to compel insurers to return the excessive profits. Most states have laws that require insurers to reduce their premiums when there is a major reduction in driving, and most state insurance regulators are required to enforce those laws.

“In virtually every state, auto insurance premiums – by law – cannot be excessive. The inability or unwillingness of almost all state insurance regulators to enforce the law and protect consumers raises serious questions,” said J. Robert Hunter, CFA’s Director of Insurance. “As we pointed out in letter after letter to insurance regulators throughout 2020, it was crystal clear that insurers’ premium relief was woefully inadequate.”

According to the insurers’ financial reports reviewed by CFA and CEJ, between 2016 and 2019, auto insurers paid 67.4 cents of every premium dollar for claims. The remaining 32.6 cents – plus investment income earned from holding policyholders’ money – covered insurer expenses and profit.

In 2020, the amount spent on claims dropped to 56.1 cents per dollar of total premium reported. Total premium of $250.6 billion reported by insurers is net of $7.9 billion in premium relief accounted for by some insurers as a reduction in premium.

“It was crystal clear that insurers’ premium relief was woefully inadequate.” – Robert Hunter

Payback was half what it should have been

As a result of the sudden change in exposure covered by auto insurance, premiums became excessive virtually overnight in mid-March 2020, CFA said.

In April and May of 2020, most of the nation’s large insurers did provide refunds or credits to consumers in response to the pandemic, but very little of the excess premium was given back after last spring and CFA research showed that even this two-month payback to policyholders was only about half of what should have been refunded.

California, Michigan, New Jersey, and New Mexico were the only states to require premium refunds during the spring of 2020. But only California continued requiring refunds beyond the first few months of the pandemic.

In March 2021, California’s Insurance Commissioner Ricardo Lara determined that auto insurers still overcharged California drivers during the pandemic and ordered them to return additional premium to consumers.

In June and July, respectively, Washington State and New Mexico announced industry data calls about auto insurance losses during the pandemic that will hopefully lead to additional premium refunds for consumers, but other regulators have not taken initial steps, let alone further steps, to recoup money for drivers by enforcing their states’ laws against excessive rates..

In addition to little or no action by most states, there has been no action at the National Association of Insurance Commissioners (NAIC) to examine the issue of auto insurers’ pandemic windfall profits, to collect data during 2020 to monitor the situation or to develop guidance for states to bring needed relief to consumers, CFA said.