California Planning Crackdown on 'Fintech' Payday, EWA Lenders

EWA loans let workers get at wages before payday rolls around, but the money comes at a cost.

California is on track to impose new regulations on high-cost forms of credit, including those generally known as Earned Wage Advance (EWA) products, which hourly workers increasingly rely on for fash cash.

Simply put, EWA is a company benefit that allows employees to receive part of their paycheck before payday, according to NerdWallet. Also called on-demand pay, it's frequently an option for hourly workers. Companies like Walmart, Amazon and McDonald’s offer EWA as part of their benefits.

The money can come in handy but it can also come at a high cost that is often not disclosed to the wage earner.

The California Department of Financial Institutions (DFPI) last week announced proposed regulations to subject EWAs, fintech payday loans, and income share agreements to the California Financing Law and to require providers to disclose the true cost of the loan and abide by interest rate caps.

The change would treat the charges associated with these products, including tips, subscription fees, and transaction-based fees, to interest rate caps and disclosure rules. Consumer groups said the proposal would help put an end to triple-digit interest on "fintech" loans in California.

“Regardless of new technology, terms, appearance, earned wage advances, income share agreements, fintech payday loans, and other fintech consumer credit products are loans, and should be regulated as such at the state and federal level,” said Rachel Gittleman, Financial Services Outreach Manager with Consumer Federation of America.

Put consumers first

The Center for Responsible Lending (CRL) also endorsed the proposal.

"The DFPI rules would put consumers first by treating EWA loans as credit products that are subject to certain protections that advocates have fought for to keep Californians safe,” said Vasudha Desikan, director of California policy at CRL.

“EWA providers depend on problematic predatory practices for collecting much of their revenue, like pressuring consumers for ‘tips’ and calling them voluntary payments. The DFPI appears to have seen through this tactic, and will require so-called voluntary payments and other fees to be calculated in the true cost of the loan,” Desikan said.

CFA's Gittleman said many of the advances turn out to have effective annual percentage rates (APR) of 328% to 348%.

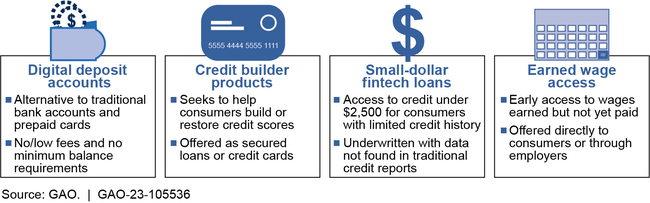

The U.S. Government Accountability Office recently recommended that the Consumer Financial Protection Bureau decide whether an EWA should be treated as a loan. Financial interests are at work at the state level around the country to enact legislation before any CFPB action.

"Fintech products may offer benefits to underserved consumers, such as those without bank accounts or credit scores, but can also pose risks," GAO said in its report. "Earned wage access purports to give consumers access to money that has been earned but not yet paid, potentially helping lower-income consumers meet financial obligations. But the costs of the product may not be transparent, and there may be risks of unexpected overdraft fees."

In Virginia, Republican Delegate Amanda Batten of James City County introduced a bill in the General Assembly earlier this year to make it easier for businesses to offer EWAs to their employees without abiding by regulations governing loans.

Jay Speer at the Virginia Poverty Law Center says the idea that this is not a loan is aimed at avoiding the legal responsibility associated with loaning money.

"When somebody advances you money that you then need to repay at a cost; that sure sounds like a loan to me," said Speer in a Virginia Public Radio report.