Buy Now, Pay Later Plans Grow, So Do Late Fees

Buy Now, Pay Later is sometimes described as credit without the credit card. It’s an increasingly popular way to buy everything from pet supplies to travel. It normally does not charge interest but late fees can add up fast and a study finds that late fees are becoming more common, rising from 7.8% in 2020 to 10.5% in 2021.

“Buy Now, Pay Later is a rapidly growing type of loan that serves as a close substitute for credit cards,” said Rohit Chopra, director of the U.S. Consumer Financial Protection Bureau. “We will be working to ensure that borrowers have similar protections, regardless of whether they use a credit card or a Buy Now, Pay Later loan.”

Highlights of Buy Now, Pay Later loans, according to a recent CFPB report, usage include:

- Loan approval rates are rising: 73% of applicants were approved for credit in 2021, up from 69% in 2020.

- Late fees are becoming more common: 10.5% of unique users were charged at least one late fee in 2021, up from 7.8% in 2020.

- More purchases are ending in returns: 13.7% of individual loans in 2021 had at least some portion of the order that was returned, up from 12.2% in 2020.

- Lenders’ profit margins are shrinking: Margins in 2021 were 1.01% of the total amount of loan

Not zero-risk

The marketing of Buy Now, Pay Later loans can make them appear to be a zero-risk credit option, but the CFPB report identified several areas of risk of consumer harm, including:

- Inconsistent consumer protections: Borrowers seeking Buy Now, Pay Later credit may encounter products that do not offer protections that are standard elsewhere in the consumer financial marketplace. These include a lack of standardized cost-of-credit disclosures, minimal dispute resolution rights, a forced opt-in to autopay, and companies that assess multiple late fees on the same missed payment.

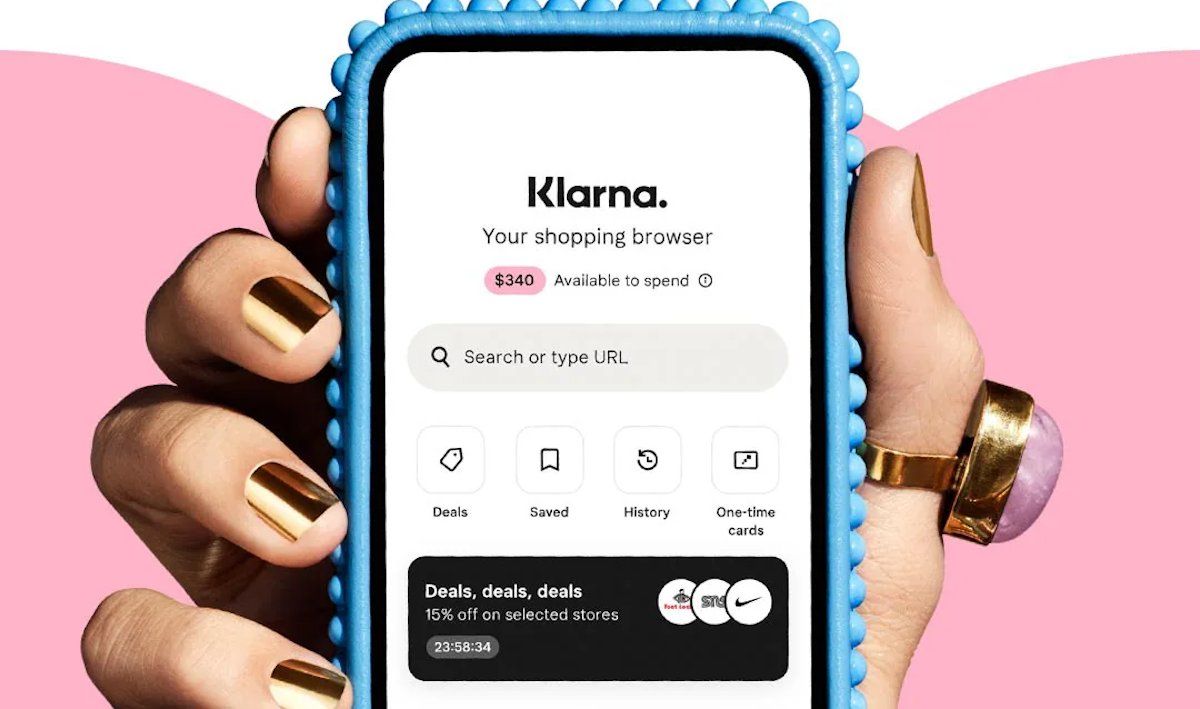

- Data harvesting and monetization: Many Buy Now, Pay Later lenders are shifting their business models toward proprietary app usage, which allows them to build a valuable digital profile of each user’s shopping preferences and behavior. The practice of harvesting and monetizing consumer data across the payments and lending ecosystems may threaten consumers’ privacy, security, and autonomy. It also may lead to a consolidation of market power in the hands of a few large tech platforms who own the largest volume of consumer data, and reduce long-term innovation, choice, and price competition.

- Debt accumulation and overextension: Buy Now, Pay Later is engineered to encourage consumers to purchase more and borrow more. As a result, borrowers can easily end up taking out several loans within a short time frame at multiple lenders or Buy Now, Pay Later debts may have effects on other debts. Because most Buy Now, Pay Later lenders do not currently furnish data to the major credit reporting companies, both Buy Now, Pay Later and other lenders are unaware of the borrower’s current liabilities when making a decision to originate new loans.

The CFPB said it will review the report’s findings to determine what its future regulatory policies should be.

Read the full text of the report, Buy Now, Pay Later: Market trends and consumer impacts

Read Director Chopra’s prepared remarks on the release of the report.

Consumers having an issue with a Buy Now, Pay Later product or service, or any other consumer financial product or service can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372).